Financial Friday - So your offer includes stocks/options?

Take the time to get a full picture of your total compensation

So you nailed that job interview and it’s offer time! It’s a big moment, because if you’re not fresh out of college, this is an important career choice. You probably interviewed because you knew the company’s products, saw potential for growth (for you and the company’s), and felt underpaid or unfulfilled at your current role.

HR at Newco reaches out and here’s your offer:

$175k base, up to $50k annual bonus (paid quarterly, measured on attainment - more later), and 10,000 shares of Newco stock, currently valued at $25/share, and “we’ll continue to grow!” said someone you interviewed with…

Sounds good, right? Well, it is about 15% more than you’re currently making and there’s upside potential with the bonus and stock!

Let’s take a magnifying glass to that offer

Base salary: Let’s refer to this as the fixed component. $175k/annually, pretty straightforward and an increase from what you’re making now

Bonus: Let’s refer to this as the variable component. Up to $50k/annually, so let’s call that $12,500/quarter based on what? Hopefully you’re very clear on what the metrics are. They should be clearly defined so you can focus on attainment. They could be achievement-based MBOs (Management by Objectives) like certifications, project completions or similar. If they are commission-based (either individual or a pooled model), make sure you understand the model (% of Gross Profit, tiers, etc.). It’s up to you to get this clarified and as quantitative as possible so you can better understand how to achieve your bonuses. You may have seen some based on “company performance”, which would be something out of your control (and it may seem pretty arbitrary if you’re not given full visibility into the numbers) so make sure you understand and can accept the offer if the bonuses aren’t always paid out.

Stock: You may hear of this referred to as RSU (Restricted Stock Units), equity (generic term for non-cash partial ownership - a stake), shares, or Options. Let’s break those down quickly:

Stock and RSUs - if your company is publicly traded, this should simply be equivalent to X number of shares in the company as if they were bought via a broker/exchange. Typically these are “restricted” for a length of time (they don’t give it to you all at once!) leading to the term RSUs. RSUs will be calculated and listed as part of your offer (in the example above, 10000 shares) but they will be awarded over time. For example it could be as simple as 25% each year for four years, or it could be tiered like 5% in year 1, 15% in year 2, then the remaining percentages over the next two years.

Options - Options are a trading derivative which is basically a contract to allow you to purchase shares if the strike price is met (In this case, these are call options, but we’re not going down the rabbit hole of calls, puts, iron condors, etc.). For example, if you are awarded 100 contracts at a $25 strike price, that’s the equivalent of 10000 shares (each option contract represents 100 shares) at $25 or higher each. So in this case, if the stock rockets to $100/share by the time you are fully vested, that’s a nice profit since your options contract enables you to buy them at $25/share then sell them at $100/share (or hang on to them - up to you). On the flip side, if the share price is less than $25 at the time of vesting, your option are “out of the money” and worthless. Options were pretty popular during the dotcom boom (I had plenty of worthless Cisco ones!) but typically it’s SBC (Stock Based Compensation) now.

Private companies - here’s where it gets a bit trickier. In a publicly traded company, all the data you need is at your fingertips via financial news sites (CNBC, Bloomberg) or aggregators like Stocktwits or TradingView. However, private companies by definition aren’t traded on a public exchange so any offers of equity need to be scrutinized.

Yes, shares in a private company do exist (documented at formation and during company minutes) and can be awarded, but their value is hard to calculate, especially if much if it is based on “when we IPO” since that’s not a guarantee. Also, even if there’s a successful IPO, there could be a restricted period where insiders can’t sell for awhile (so they don’t negatively impact the share price so close to the IPO).

There are no guarantees

If the past 2+ years has taught us anything, it’s that there are no guarantees. Our more-than-a-decade stock market bull run is over and now our biggest and brightest technology names are floundering - some down more than 80% from their all time highs. So what does this mean for the SBC referenced earlier? Is stock worthless?

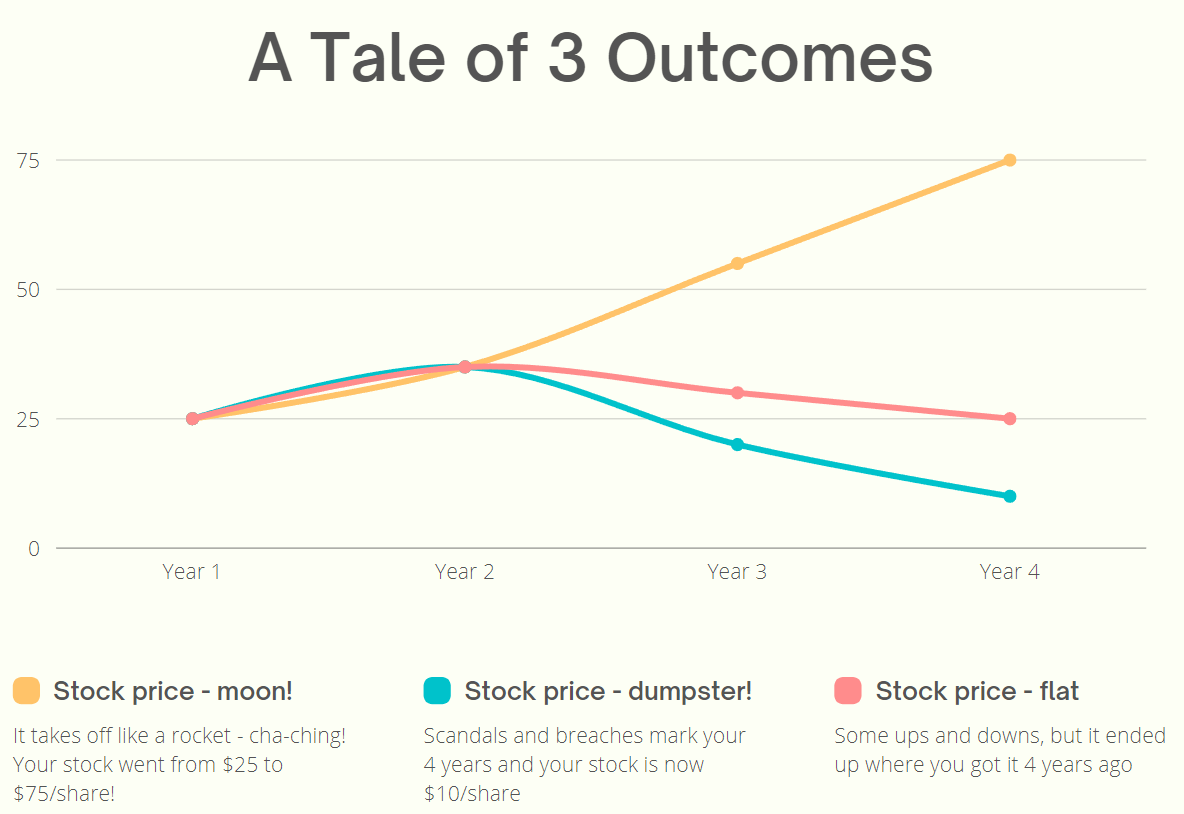

Look, it’s still “free” money, but it just isn’t as valuable as it was so let’s look at a graph:

In the previous example, your offer included 10,000 shares of stock at a current market value of $25/share and after 4 years, you’re now fully vested:

Stock price - moon: Your initial award was worth $250,000 and is now worth $750,000! In addition to your salary and bonuses over that time, I’d say that’s a clear win.

Stock price - dumpster: Your initial award was worth $250,000 and is now worth $100,000. Sad trombone. Look it’s not all doom and gloom since that’s still now your money, but that adds up to just an extra $25k/year. Could you have done better somewhere else after a year? Added a side hustle?

Stock price - flat: Your initial award is still worth the same $250,000 which is not bad at all. Depending on how much you vested in the first year or two, it could be worth a look around if you’re needing to earn more.

Stock-based compensation surely isn’t what it used to be. I know people hired at CompanyZ when it was trading at higher than $300/share. It’s now down to less $80/share. It doesn’t mean that their shares are worthless! They are certainly worth less than they were prior, but it’s still “free” money (¯\_(ツ)_/¯). As long as your company remains a “going concern” and doesn’t file for bankruptcy (<_<), your shares will still be worth something. Options, on the other hand, could be worthless if they don’t hit the strike price. And that trendy startup that didn’t IPO? Yeah, your equity is now zero.

Opportunity costs

Again, no one can predict the future, but hopefully this helps illustrate what your total compensation really looks like over the next few years. Is your new company really on a rocket-like trajectory with no end in sight? Or is it a slow and steady one that is recession-proof?

Is your stock vesting plan so back-end loaded that you can walk away after year 1 (if the stock price is in the toilet) for a new opportunity with a better offer?

Did your small startup get acquired pre-IPO and your equity is now worth 20x?

The job market is still hot and it pays (now and in the long-run) to understand all the possibilities and the big picture over time.

Business Insider

https://www.businessinsider.com/stock-based-compensation-wrecking-tech-shares-stock-slump-2022-12